HMRC notes (pages 22-24) ct600-guide

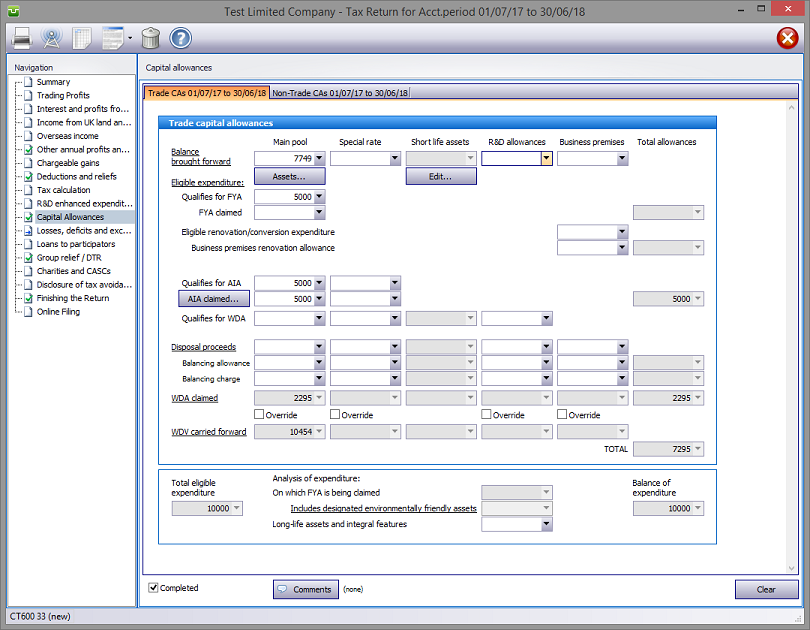

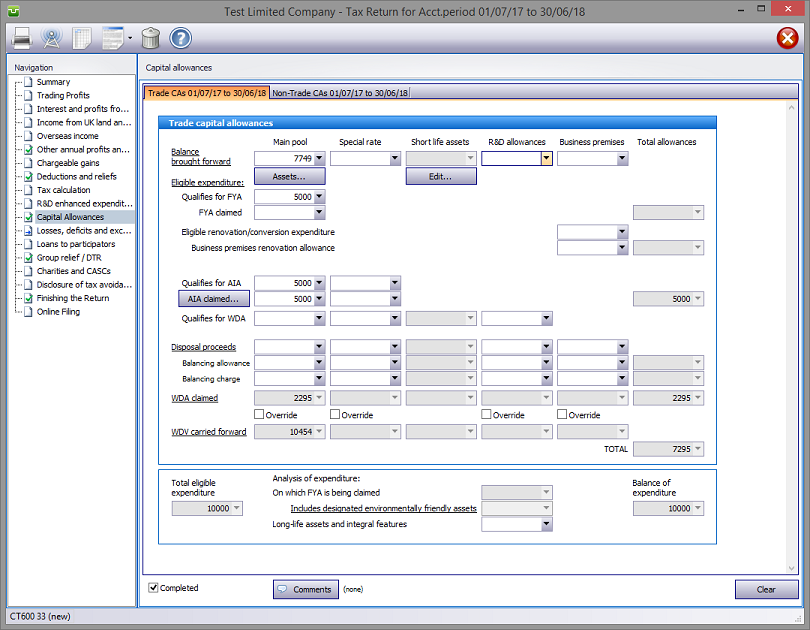

In the Navigation pane click on Capital Allowances and select the relevant tab.

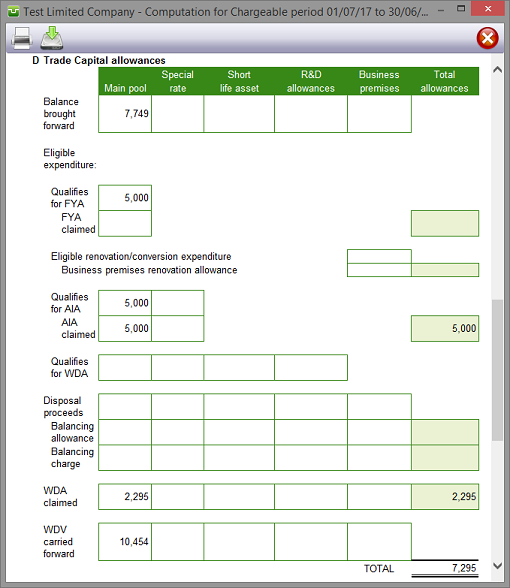

There are separate input screens for Trade and Non-Trade CA's into which the relevant details are entered manually.

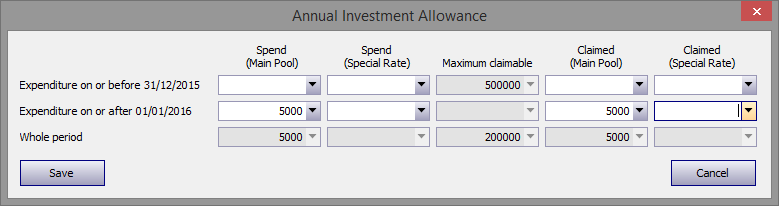

Hit the AIA Claimed button to make the appropriate AIA entries in this screen.

Please note:

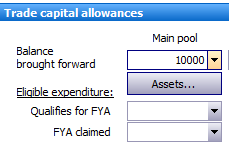

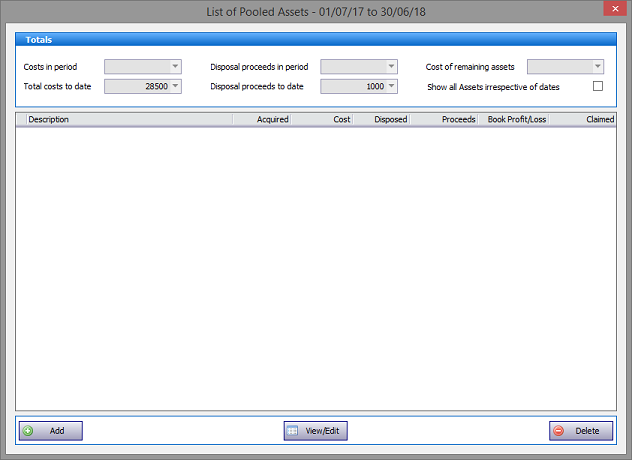

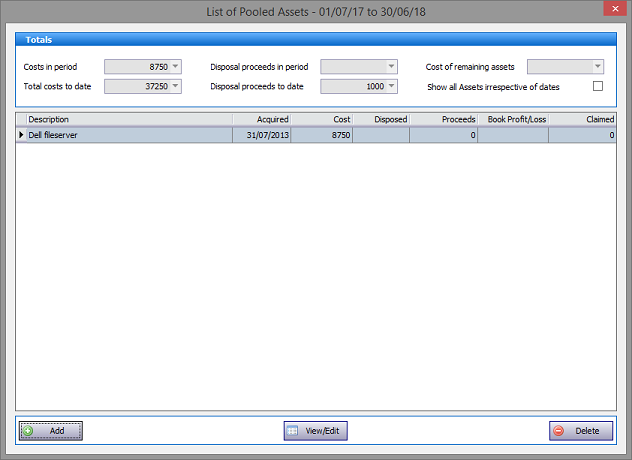

Use this feature to build the client's Asset Register. Click on the Assets button underneath Main pool - Balance brought forward to access the Assets Register.

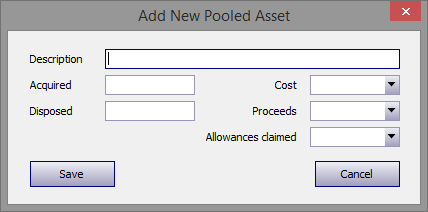

Next hit the Add button and make the appropriate entries.

Presently this feature does not carry into the Capital Allowance computations.

Calculation summarises capital allowances.

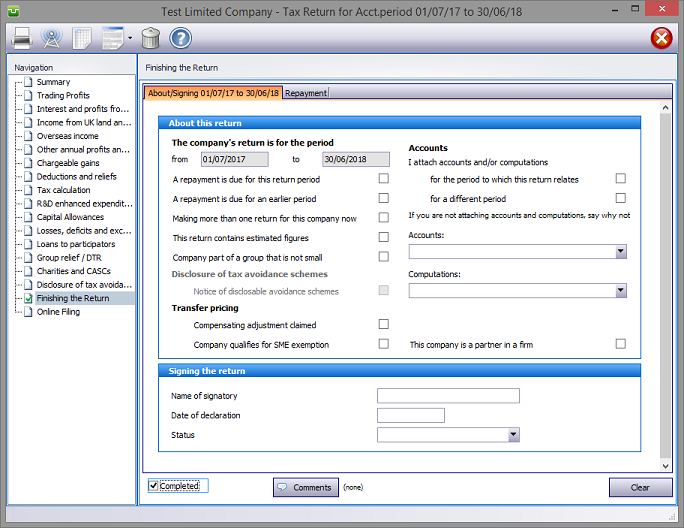

Finishing

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of comments appear to the right of the relevant boxes.

(pages 22-24) ct600-guide

Copyright © 2025 Topup Software Limited All rights reserved.